Why Working Families Aren’t Feeling the Gains Despite Rising Productivity

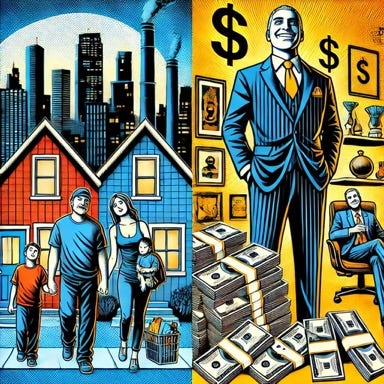

For over fifty years, the story of the American middle class has been sold as one of steady progress. But the reality? That progress flatlined decades ago. Today, if wages had kept pace with both inflation and productivity growth since the 1970s, the average middle-class income would sit at an impressive $176,000 annually. Instead, it’s hovering around $85,000—and that’s on a dual income. This post will dig into why that gap exists, who’s benefiting from it, and what needs to change to restore economic fairness.

The Vanishing Promise of Productivity Gains

In theory, rising productivity should mean more wealth for everyone involved. The economic logic is simple: as workers produce more per hour, the resulting wealth should trickle down, lifting wages and improving living standards across the board. But that hasn’t been the case. Since the late 1970s, productivity in the U.S. has soared, while wages for middle-class workers barely budged.

So, where did the money go? The lion’s share went to CEOs and shareholders, leaving everyday Americans with wages that didn’t even keep pace with inflation. Instead of rising alongside the productivity they helped create, middle-class incomes stagnated, transforming the American dream into something far out of reach for most.

Income Stagnation: Living on Two Incomes

In the 1970s, a single income was often enough to support a family, buy a home, and set aside savings for the future. Today, that’s a pipe dream for most. The modern middle-class family requires two incomes to keep up with basic expenses, let alone save or invest for the future. This shift wasn’t a natural evolution; it was the result of deliberate policies that prioritized shareholder gains over worker paychecks.

While productivity has more than doubled since the 1970s, the average worker has seen only minimal wage increases. Adjusted for inflation, wages haven’t changed dramatically, even though the cost of living has soared. Housing, education, and healthcare—the essentials of middle-class stability—are now increasingly unaffordable. Instead of upward mobility, the middle class faces a treadmill where they have to run harder just to stay in the same place.

CEO Compensation: The True Beneficiaries of Productivity

The same era that brought wage stagnation for middle-class workers saw an explosion in CEO compensation. In 1978, the average CEO made about 30 times the salary of an average worker. By 2021, that figure skyrocketed to 366 times. These CEOs aren’t performing miracles—they’re just benefiting from a system that disproportionately rewards those at the top, often by cutting costs (i.e., workers’ wages) and outsourcing labor.

This inequality isn’t the result of market forces alone. It’s the outcome of policies like the weakening of labor unions, deregulation, tax cuts for the wealthy, and stock buybacks that prioritize short-term gains over long-term stability. The CEOs and corporate boards who control these companies have rigged the system to ensure that every bit of extra value generated by productivity flows upward, leaving middle-class workers with crumbs.

The Middle Class Bears the Cost

The cost of this imbalance isn’t just financial. Families today face higher levels of stress, less time with their children, and fewer opportunities for upward mobility. The American workforce is more educated, more productive, and more dedicated than ever, but those efforts aren’t translating into financial security or a better quality of life. Instead, the rising costs of essentials like healthcare and housing are eating away at stagnant wages, leaving many families on the brink of financial ruin.

The generational impact of this cannot be ignored. Millennials and Gen Z are now the most educated generations in history, yet they’re less likely to own homes, build savings, or feel financially secure compared to previous generations. The promise that each generation will do better than the last has been broken, and the middle class is paying the price.

What Needs to Change?

1. Reintroduce Fair Taxation: A progressive tax system that holds corporations and the ultra-wealthy accountable can reinvest funds back into public services and middle-class relief.

2. Strengthen Worker Protections and Unions: Unions have historically been a powerful force in securing fair wages. By rebuilding labor protections, workers can negotiate for wages that match their productivity.

3. End Stock Buybacks and Focus on Long-Term Growth: Corporations need to invest in their workers, not just their stock prices. Limiting stock buybacks could redirect funds towards higher wages and benefits for employees.

4. Cap CEO Compensation Ratios: A reasonable cap on CEO-to-worker pay ratios could rein in excessive executive compensation and redirect funds back to the workforce.

5. Introduce a Living Wage: Aligning wages with the true cost of living—adjusted for productivity—can bring balance back to the workforce and empower the middle class to thrive, not just survive.

Final Thoughts

The gap between productivity and pay isn’t a natural phenomenon; it’s the result of policies that systematically favor corporate elites over American workers. Reversing this trend requires collective action and a demand for change. The middle class shouldn’t have to settle for a stagnant income while the wealthiest siphon off the fruits of their labor. Restoring economic fairness isn’t just an ideal—it’s a necessity for a sustainable future. Let’s bring back the American dream for everyone, not just those at the top.

Greedbane

11/10/2024

Sources

1. Mishel, Lawrence, and Julia Wolfe. CEO Compensation Has Grown 940% Since 1978. Economic Policy Institute, 2019.

2. Autor, David, et al. The Fall of the Labor Share and the Rise of Superstar Firms. The Quarterly Journal of Economics, 2020.

3. U.S. Bureau of Labor Statistics. Productivity and Costs, 1973-2021.